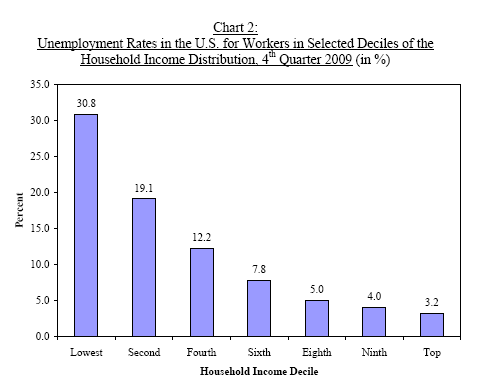

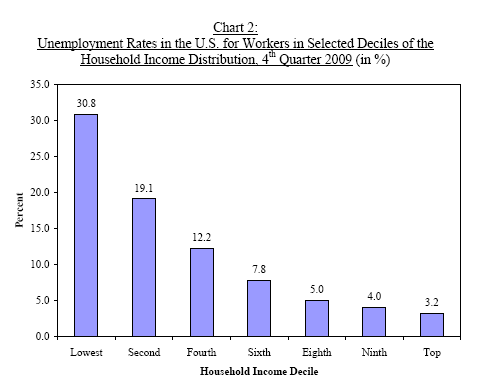

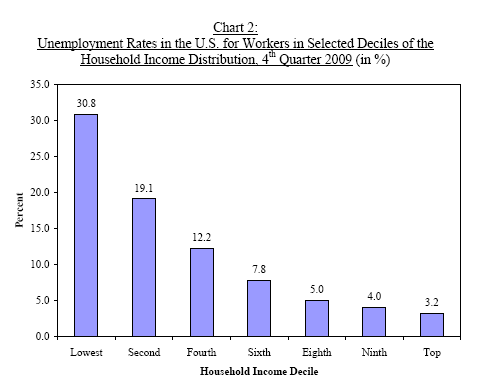

Over 6.5 million of the 15 million unemployed Americans have been out of work for 27 weeks or more. As a percent, this is the highest number of long-term unemployed we have had since the Great Depression. What is not discussed in this recession is the working poor and middle class have taken on the burden of this financial calamity disproportionately. We are not all in this equally. When was the last time you heard on the mainstream press that 40 million of your fellow Americans are now receiving food assistance? And when was the last time you heard that jobs for the middle class are still largely disappearing? Since much of the media represents the top 1 percent they assume all is well because Wall Street has been on a record breaking bailout rally. At the same time, we have 30 percent unemployment at the lower end of our income scale.

The lower 30 percent are seeing depression like unemployment rates:

Source: Center for Labor Market Studies, Northeastern University

This chart really is a reflection of the current recovery. For the bottom 40 percent, this recession is still extremely painful and realistic. Yet the top 10 percent have an unemployment rate of 3.2 percent which isn’t necessarily a bad number. When we break down the numbers, we realize that the middle class in this country is struggling to get by. The 40 million on food assistance are scraping by. The Wall Street stock market casino is merely a far away distraction to this group. It would be one thing if the rally actually reflected a large boost in job growth in the real economy. Yet last month a large part of the actual added jobs came from Census hiring from the government. This is unsustainable.

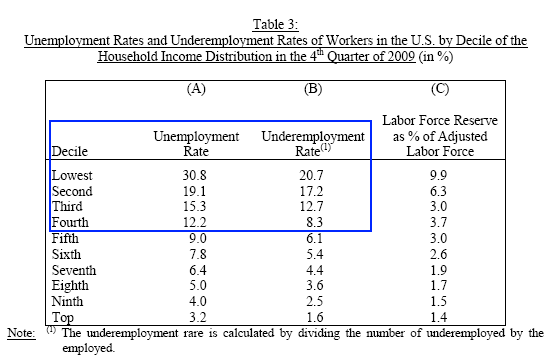

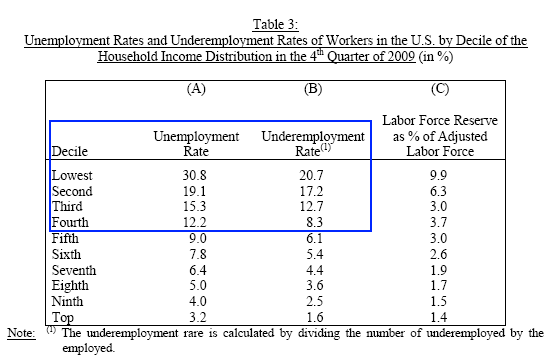

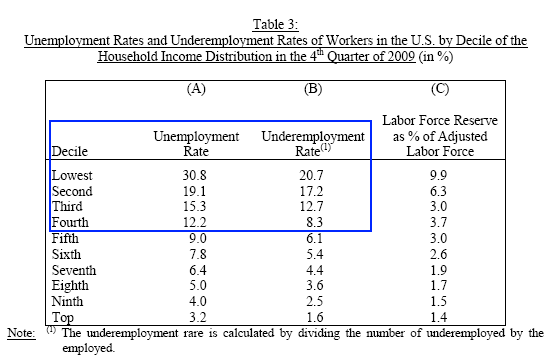

If we break down the numbers further, we realize that employment is only good for the top 20 percent:

Many economists argue that a 5 percent unemployment rate is typically where a steady economy would hover around. Yet look at the above chart. You have to be in the top income deciles to even see this rate. Anyone from the seventh all the way down to lowest cutoff point is feeling unemployment rates that are elevated from the “normal” point. And part of this has to do with the top 1 percent controlling over 42 percent of all financial wealth. While most have to work to pay their bills or stay current with their mortgage, we have a tiny percentage of our country that largely make money from watching their stock portfolio throw off dividends. In fact, this has become a zero sum game. The trillions in bailout money that went to Wall Street are trillions that didn’t go to creating jobs for working poor and middle class Americans. How many jobs can you create with $13 trillion? Apparently not many if you give Wall Street most of it.

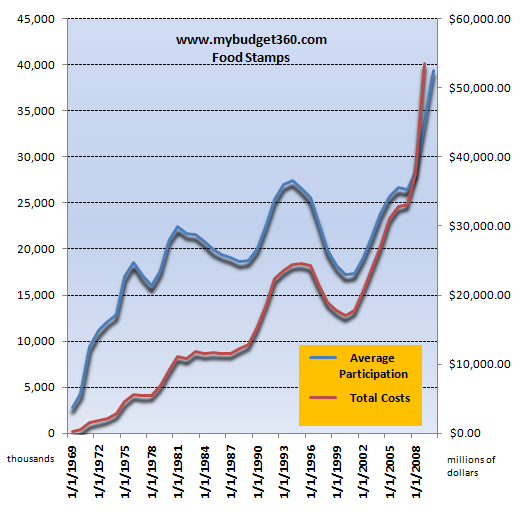

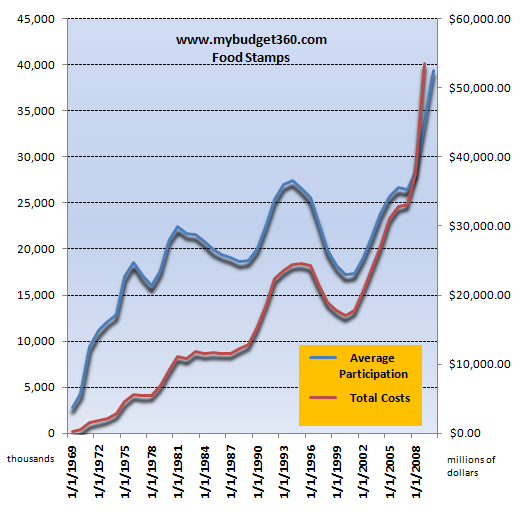

Most of the funds have been channeled into outrageous bonuses and keeping the fragile casino going further so they don’t have to go out and actually work like most Americans. The long-term unemployed are enormous and the below chart is incredible:

The chart just goes off the normal path in this recession because many of these jobs are gone forever. Many of these jobs were essentially support positions for the Wall Street casino. Now that Wall Street siphoned off enough money from the productive economy, they are now looking for other bubbles to expand. It doesn’t matter if it comes at the expense of the working poor and middle class. In fact, this is what they want people to believe. They want you to believe that they barely have enough to get by yet at the same time, are able to reward each other with billion dollar bonuses each quarter now that they have taxpayer money in hand. This kind of hypocrisy and corruption is primarily why most Americans are simply not buying the nonsense perpetrated on Wall Street any further.

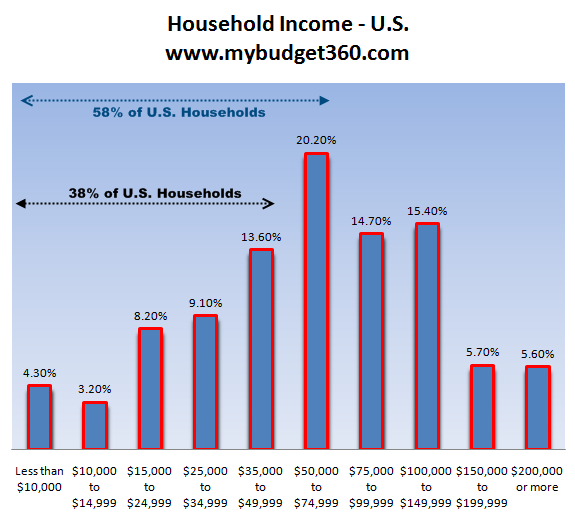

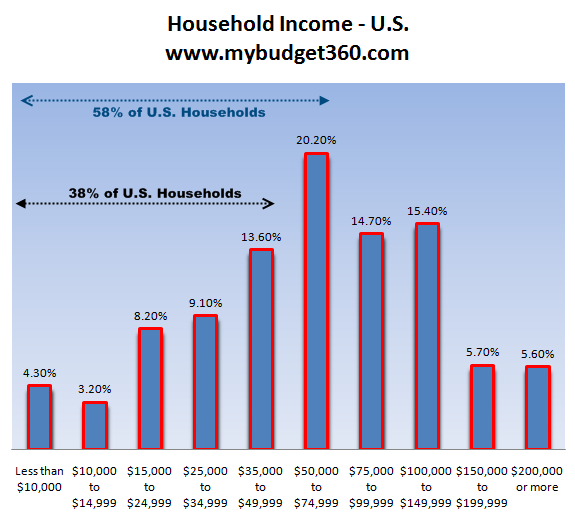

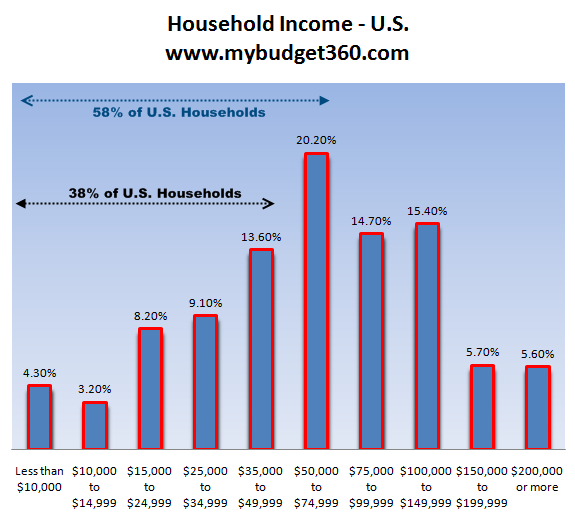

And U.S. households are making due with a lot less:

“65% of American households get by with $65,000 a year or less. This number is going to be lower once we get the 2009 Census data in September but after rising health care costs, more expensive education, and rising food costs many Americans are seeing their fixed costs go up while their wages move in the opposite direction. But keep in mind there is a group that is actually benefitting from this entire cost cutting. After all, the stock market isn’t up by 70+ percent by accident.”

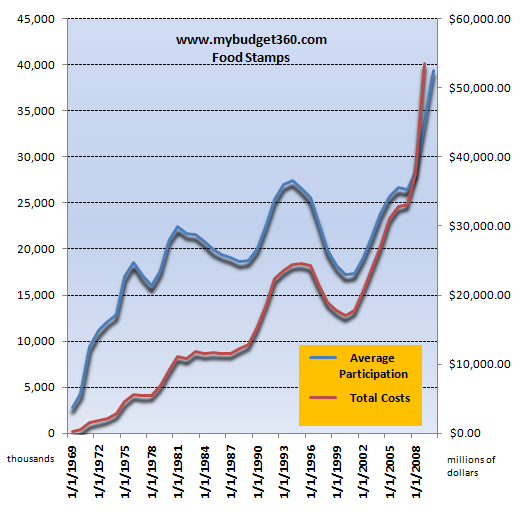

Since the recession started, we have added close to 500,000 per month needing food assistance:

How does this translate to a recovery? The trend hasn’t even reversed yet those on Wall Street and the mainstream press being so out of touch with most Americans thinks all is now well because their dividends are still coming in. That is clearly not the case and we stand at a crossroads to protect the middle class. If we allow Wall Street to operate unchecked and like a casino, we are only setting ourselves up for another financial crisis that will be coming up in a short time. Why wouldn’t it? We’ve been in this boom and bust casino for the last few decades and each time this happens, someone gets rich. The Goldman Sachs case is about a hedge funder who placed a major bet that American housing would collapse and made billions off of that bet. What did this add to our economy? Clearly the working poor and middle class don’t find amusement that you can bet on their failure and laugh all the way to the bank.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

– The cloaked recovery for the middle class. How 30 percent of the poor are unemployed.

Over 6.5 million of the 15 million unemployed Americans have been out of work for 27 weeks or more. As a percent, this is the highest number of long-term unemployed we have had since the Great Depression. What is not discussed in this recession is the working poor and middle class have taken on the burden of this financial calamity disproportionately. We are not all in this equally. When was the last time you heard on the mainstream press that 40 million of your fellow Americans are now receiving food assistance? And when was the last time you heard that jobs for the middle class are still largely disappearing? Since much of the media represents the top 1 percent they assume all is well because Wall Street has been on a record breaking bailout rally. At the same time, we have 30 percent unemployment at the lower end of our income scale.

The lower 30 percent are seeing depression like unemployment rates:

Source: Center for Labor Market Studies, Northeastern University

This chart really is a reflection of the current recovery. For the bottom 40 percent, this recession is still extremely painful and realistic. Yet the top 10 percent have an unemployment rate of 3.2 percent which isn’t necessarily a bad number. When we break down the numbers, we realize that the middle class in this country is struggling to get by. The 40 million on food assistance are scraping by. The Wall Street stock market casino is merely a far away distraction to this group. It would be one thing if the rally actually reflected a large boost in job growth in the real economy. Yet last month a large part of the actual added jobs came from Census hiring from the government. This is unsustainable.

If we break down the numbers further, we realize that employment is only good for the top 20 percent:

Many economists argue that a 5 percent unemployment rate is typically where a steady economy would hover around. Yet look at the above chart. You have to be in the top income deciles to even see this rate. Anyone from the seventh all the way down to lowest cutoff point is feeling unemployment rates that are elevated from the “normal” point. And part of this has to do with the top 1 percent controlling over 42 percent of all financial wealth. While most have to work to pay their bills or stay current with their mortgage, we have a tiny percentage of our country that largely make money from watching their stock portfolio throw off dividends. In fact, this has become a zero sum game. The trillions in bailout money that went to Wall Street are trillions that didn’t go to creating jobs for working poor and middle class Americans. How many jobs can you create with $13 trillion? Apparently not many if you give Wall Street most of it.

Most of the funds have been channeled into outrageous bonuses and keeping the fragile casino going further so they don’t have to go out and actually work like most Americans. The long-term unemployed are enormous and the below chart is incredible:

The chart just goes off the normal path in this recession because many of these jobs are gone forever. Many of these jobs were essentially support positions for the Wall Street casino. Now that Wall Street siphoned off enough money from the productive economy, they are now looking for other bubbles to expand. It doesn’t matter if it comes at the expense of the working poor and middle class. In fact, this is what they want people to believe. They want you to believe that they barely have enough to get by yet at the same time, are able to reward each other with billion dollar bonuses each quarter now that they have taxpayer money in hand. This kind of hypocrisy and corruption is primarily why most Americans are simply not buying the nonsense perpetrated on Wall Street any further.

And U.S. households are making due with a lot less:

“65% of American households get by with $65,000 a year or less. This number is going to be lower once we get the 2009 Census data in September but after rising health care costs, more expensive education, and rising food costs many Americans are seeing their fixed costs go up while their wages move in the opposite direction. But keep in mind there is a group that is actually benefitting from this entire cost cutting. After all, the stock market isn’t up by 70+ percent by accident.”

Since the recession started, we have added close to 500,000 per month needing food assistance:

How does this translate to a recovery? The trend hasn’t even reversed yet those on Wall Street and the mainstream press being so out of touch with most Americans thinks all is now well because their dividends are still coming in. That is clearly not the case and we stand at a crossroads to protect the middle class. If we allow Wall Street to operate unchecked and like a casino, we are only setting ourselves up for another financial crisis that will be coming up in a short time. Why wouldn’t it? We’ve been in this boom and bust casino for the last few decades and each time this happens, someone gets rich. The Goldman Sachs case is about a hedge funder who placed a major bet that American housing would collapse and made billions off of that bet. What did this add to our economy? Clearly the working poor and middle class don’t find amusement that you can bet on their failure and laugh all the way to the bank.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

No comments:

Post a Comment